The Power and Challenges of Virtual Payments in Business Travel

By Jean-Michel Kadaner

The settlement of business travel is a critical part of corporate operations, but traditional payment methods can be complex – creating inefficiencies, security risks, and compliance challenges.

Virtual payment solutions have appeared to be a game-changer, offering a smarter, safer, and more streamlined way to pay for corporate travel. This shift is driving significant market growth, with the global virtual cards market valued at approximately USD 19 billion in 2024 and projected to reach USD 90 billion in 2033—a compound annual growth rate (CAGR) of approximately 20 %over the period.

In this blog, we will explore the challenges of traditional corporate travel payments, the virtual payment solutions available today, and how businesses can implement and improve these technologies.

Why Traditional Payments Fall Short

Inefficiencies in Managing Corporate Travel Expenses

Managing travel expenses with traditional credit cards and reimbursement processes is time-consuming. Manual reporting, receipt tracking, and reconciliation cause administrative burdens, leading to delayed reimbursements and financial discrepancies.

Fraud Risks and Security Concerns with Physical Cards

Corporate cards can be lost, stolen, or misused, posing security risks. Additionally, fraudulent transactions and unauthorized spending are familiar challenges, particularly when employees share card details with third parties or vendors.

Difficulty in Tracking and Reconciling Payments Across Multiple Vendors

Businesses often struggle to track and combine payments across airlines, hotels, car rentals, and travel agencies. Without centralized tracking, it becomes difficult to enforce compliance and ensure correct expense reporting.

The Rise of Unmanaged Spend, Especially for Last-Minute or Infrequent Travelers

Occasional travelers, consultants, and remote employees may not have access to corporate cards, leading to out-of-pocket expenses or unmanaged spending. Last-minute travel bookings can further complicate budget control and policy enforcement.

Types of Cards and What Sets Virtual Apart

Virtual cards, corporate cards, purchasing cards, and lodge cards all serve different purposes in corporate travel and expense management. Here is a breakdown of their key differences:

Card Type | Key Features | Best For | Pros & Cons |

Virtual Card: (Single Use) |

| Hotel, air, or one-off purchases | High security, control, no physical card |

Corporate Card |

| Regular travel expenses, including meals, transportation, client entertainment, etc. | Easy to use, but risky if lost or misused |

P-Card |

| Office supplies, vendor payments | Good for procurement, but comes with shared use risks |

Lodge Card |

| Centralized agency bookings | Consolidated billing, secure, no card to lose |

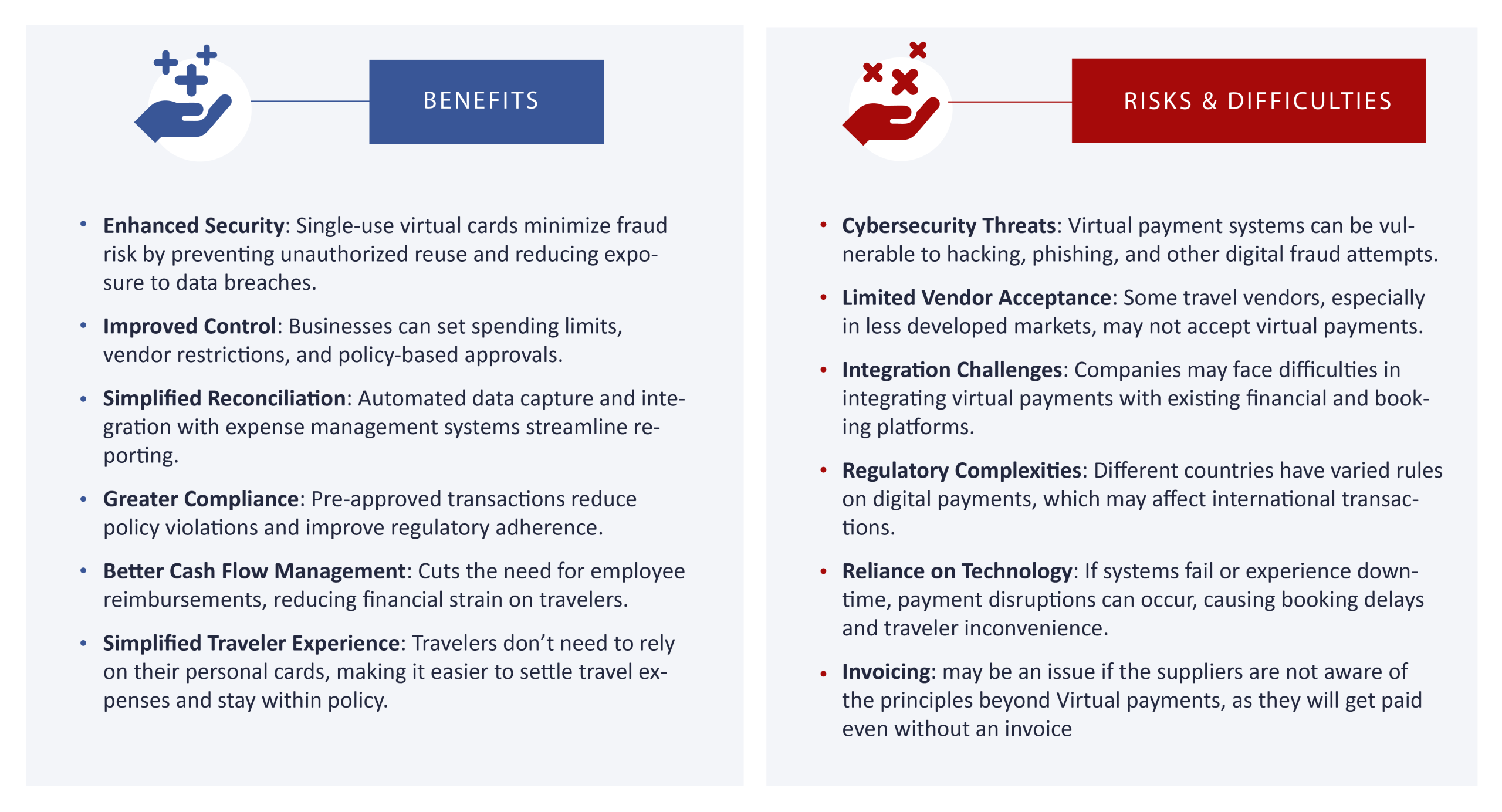

What Virtual Payment Solutions Offer Today and the Challenges They Bring

Whether you are using a single use card or a multi-use lodge card for travel bookings through your TMC, there are several benefits, including:

- Seamless integrations with travel booking platforms and expense management systems, enabling real-time tracking, automated reconciliation, and compliance enforcement.

- Enhanced capabilities through fintech innovations, such as API-based payment solutions and AI-driven fraud detection, enabling real-time payment tracking and automated approvals for greater oversight.

- Enhanced control, security, and compliance through pre-set spending limits and restrictions, unique card numbers to prevent fraud, and automated data capture for simplified regulatory adherence and reporting.

Regional Trends in Virtual Card Adoption

Regional Trends in Virtual Card Adoption

Virtual card adoption is accelerating globally, but the pace and drivers vary by region.

- Europe currently leads the global market, accounting for nearly 38% of revenue in 2023, with Germany and the UK embracing virtual cards due to widespread digital payment infrastructure and smartphone usage.

- The Asia-Pacific region is the fastest-growing, fueled by rapid digital transformation, increased internet access, and a rising middle class.

- In North America, a mature banking system and openness to financial innovation have helped virtual cards gain early traction, particularly in the U.S.

- Meanwhile, Latin America is emerging as a growth region, with Brazil and Mexico advancing digital payments through financial inclusion initiatives.

These regional dynamics highlight the need for globally scalable virtual payment solutions that can flex to local market realities.

Getting Started or Optimizing Your Virtual Payments Approach

- Assess your current payment landscape and find gaps and pain points: Evaluating your existing travel payment processes will help pinpoint inefficiencies and show security risks or compliance issues.

- Engage key stakeholders, including Travel, Finance, Procurement, and IT: Collaborating across departments ensures alignment in selecting a virtual payment solution that meets financial, operational, and security needs.

- Choose the right virtual payment solution by considering integration, global acceptance, and policy alignment: Selecting a provider that integrates seamlessly with existing travel and expense management systems, supports international transactions, and aligns with corporate policies.

- Educate travelers and suppliers to ensure smooth adoption and compliance: Train employees and vendors on how to use virtual payments, emphasizing benefits such as security, ease of use, and policy adherence.

- Monitor and refine – Leveraging data insights to refine usage and reporting: Regularly analyze transaction data to show trends, improve travel spending, and improve policy compliance.

The Future of Virtual Payments in Business Travel

Virtual payments are rapidly evolving, driven by several key trends:

- AI and machine learning will boost fraud detection, automate reconciliation, and improve expense forecasting.

- Mobile payment solutions will streamline transactions and enhance the traveler experience.

- As remote work and hybrid travel increase, virtual payments will support dynamic policies, offering travelers greater flexibility while keeping financial oversight.

Looking ahead, we expect to see:

- Greater adoption of real-time payment solutions

- Expansion of biometric and tokenized payment security

- Increased regulatory frameworks supporting virtual payment adoption.

Conclusion

Virtual payments are revolutionizing business travel by addressing inefficiencies, enhancing security, and streamlining expense management. While risks exist, proper implementation and continuous monitoring can mitigate challenges, making virtual payments an asset for corporate travel management. Companies that adopt and improve virtual payment solutions will gain a competitive edge, improving both traveler experience and financial control. Now is the time to evaluate your payment landscape and embrace the future of corporate travel payments.

[Sources:]

AREKA is an independent firm providing customized, end-to-end business travel management services to organizations worldwide. Areka’s aim is to empower travel managers and buyers to reach higher performance targets across all areas of their travel program, including corporate travel, expense, and strategic meetings management.

Contact the team today!